Shoeboxed Review: A Complete Receipt Management Solution for Small Business Owners

Running a small business means juggling countless receipts, expense reports, and financial documents. If you've ever found yourself frantically searching through crumpled papers in your car's glove compartment during tax season, you'll understand the problem Shoeboxed solves. This cloud-based receipt scanning and expense management platform promises to transform your chaotic paper trail into an organized digital system.

But does it deliver on that promise? After diving deep into its features, pricing, and user feedback, here's what you need to know about whether Shoeboxed deserves a spot in your business toolkit.

What Shoeboxed Actually Does

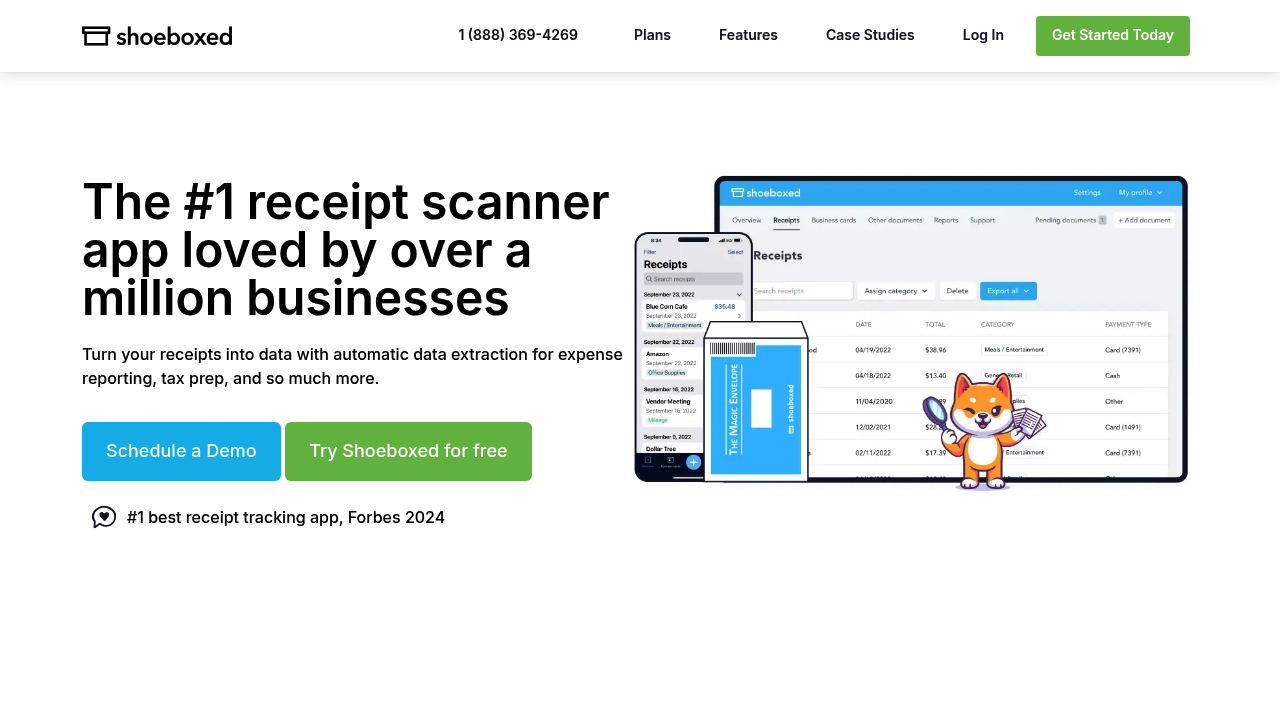

Shoeboxed tackles the universal small business headache of receipt management through multiple capture methods. You can snap photos with their mobile app, email receipts to a designated address, or even mail physical receipts using their prepaid "Magic Envelopes" service. The platform then digitizes everything using OCR technology, extracting key data like vendor names, amounts, dates, and payment methods.

The service has attracted over 1 million business owners who use it to scan and organize receipts, create expense reports, and track mileage. The automatic categorization feature sorts receipts into 15 common tax categories, which can save significant time during bookkeeping sessions.

What sets Shoeboxed apart from basic receipt apps is its human verification process. After OCR scanning, real people review and correct the extracted data, ensuring accuracy that purely automated systems often miss. This hybrid approach addresses one of the biggest frustrations with receipt scanning technology—the inevitable errors that occur when machines try to read crumpled receipts or faded thermal paper.

Who Should Consider Shoeboxed

Shoeboxed works best for small business owners, freelancers, and solopreneurs who generate moderate to high volumes of receipts but don't need full accounting software. It's particularly valuable for service-based businesses, consultants, and anyone who frequently travels or entertains clients.

The platform shines when you need reliable data extraction without the tedious manual entry that comes with simpler apps. If you're currently using a shoebox (literally or figuratively) to store receipts, or if you're spending hours each month manually entering expense data, Shoeboxed can dramatically streamline your workflow.

However, it's less ideal for businesses that primarily deal with digital transactions or those already using comprehensive accounting software with built-in receipt management. The service also might be overkill for very small operations with minimal expense tracking needs.

Key Features That Matter

The Magic Envelope service deserves special mention because it's genuinely unique. You can stuff receipts into prepaid envelopes and mail them to Shoeboxed's processing center, where they're scanned and digitized. This sounds almost quaint in our digital age, but it's incredibly practical for businesses that accumulate physical receipts throughout the month.

The mobile app provides the instant gratification most users expect, with quick photo capture and immediate data extraction. The OCR technology works well on clear receipts, though the human verification step is what makes the data truly reliable.

Integration with QuickBooks and Xero can drastically save time and effort when it comes to bookkeeping and accounting, allowing expense data to flow directly into your existing financial systems. This eliminates the double-entry problem that plagues many small businesses.

The mileage tracking feature automatically calculates business travel expenses, and the business card scanning functionality helps manage networking contacts. These additions make Shoeboxed more than just a receipt app—it becomes a comprehensive expense management hub.

Pricing and Plans

Shoeboxed offers three plans with prices ranging from $29 to $89 per month when billed monthly, with a 20% discount for annual billing. The pricing reflects the human verification component, making it more expensive than purely automated alternatives.

The entry-level plan handles basic receipt scanning and expense categorization, while higher tiers add features like unlimited users, advanced reporting, and priority processing. The company occasionally offers promotional discounts, including a current 25% savings opportunity.

All plans include a 30-day free trial, though you'll need to provide credit card information upfront. This trial period should give you enough time to test whether the service fits your workflow and whether the data accuracy justifies the cost.

How It Compares to Alternatives

Shoeboxed occupies a unique middle ground between simple receipt apps and full accounting software. Apps like Expensify offer similar functionality at lower price points, but they rely more heavily on automated processing, which can mean more errors and manual corrections.

Full accounting platforms like FreshBooks or QuickBooks include receipt scanning features, but they're part of much larger systems that many small businesses don't need. Some alternatives have limitations, missing advanced functionalities like autoforwarding receipts from email or creating custom tags and categories.

The human verification component is Shoeboxed's main differentiator. While this increases costs, it also increases accuracy, which can be crucial for tax preparation and audit situations. If you've ever had to reconstruct expenses from blurry receipt photos, you'll appreciate this attention to detail.

Where Shoeboxed falls short is in advanced analytics and reporting compared to dedicated accounting software. It's designed for expense capture and organization rather than comprehensive financial analysis.

The Real-World Experience

User feedback consistently highlights the time savings and organization benefits, particularly for businesses that previously relied on manual systems. One user noted that the service "solves all the pain points" and helps significantly during IRS audits by making documents easily searchable.

The Magic Envelope service receives particularly positive reviews from users who accumulate receipts throughout the month. Being able to dump everything into an envelope and have it professionally processed appeals to busy business owners who value their time.

However, some users find the monthly costs high compared to DIY alternatives, especially for businesses with relatively few receipts. The human verification process, while more accurate, also means slightly longer processing times compared to instant automated scanning.

Making the Decision

Shoeboxed makes sense if you're currently spending significant time on receipt management and need reliable data extraction. The service pays for itself when you factor in the time saved on bookkeeping and the reduced risk of missing deductions due to poor organization.

It's particularly valuable during tax season when having properly categorized, searchable receipts can save hours of work. The integration with popular accounting software means your expense data flows seamlessly into your existing financial processes.

However, if you're already using comprehensive accounting software with adequate receipt management, or if you generate very few receipts, the monthly cost may not justify the benefits. The service works best for businesses that treat receipt management as a genuine pain point rather than a minor inconvenience.

The Bottom Line

Shoeboxed delivers on its core promise of transforming receipt chaos into organized digital records. The combination of multiple capture methods, human verification, and accounting software integration creates a robust solution for small business expense management.

The pricing reflects the premium nature of the service, but for businesses that value accuracy and time savings over cost minimization, it represents solid value. The 30-day trial provides enough time to determine whether the workflow improvements justify the monthly investment.

If you're tired of wrestling with receipt management and want a solution that actually works reliably, Shoeboxed deserves serious consideration. Visit their website to start your free trial and see if it transforms your expense tracking the way it has for over a million other business owners.